Embarking on a gummy making business journey requires more than just passion. It's about smart financial planning.

To secure funding and develop a financial plan for your gummy making business, begin by estimating the total costs involved, including facilty rent, raw materials, manufacturing, packaging, marketing, and employee salaries. Then, explore funding options like self-funding, loans, grants, or investor capital. Proper pricing strategies will ensure profitability.

While this gives you a foundational overview, diving deeper into each aspect—such as funding sources and cost estimation techniques—can significantly enhance your success. Read on to discover detailed insights that will equip you with the necessary tools to build a financially robust gummy business.

Gummy making requires low initial capital investment.False

Gummy making involves significant costs like materials, packaging, and salaries.

Investor capital is a viable funding source for gummy businesses.True

Investor capital can provide necessary funds for growth and operations.

What Are the Key Cost Components of a Gummy Making Business?

Starting a gummy making business involves several cost components that need careful planning. Understanding these can help entrepreneurs like you navigate the financial landscape effectively.

The key cost components of a gummy making business include production plant, raw materials, machinery, labor, packaging, and marketing. Each component demands a strategic approach to manage expenses efficiently while maintaining product quality.

Raw Materials and Ingredients

The backbone of any gummy production lies in its ingredients. Gelatin, pectin, and sugar are some of the primary raw materials. Each type comes with its own price point. While gelatin is cost-effective, pectin offers a plant-based alternative. Consider your target market's preferences before sourcing ingredients1.

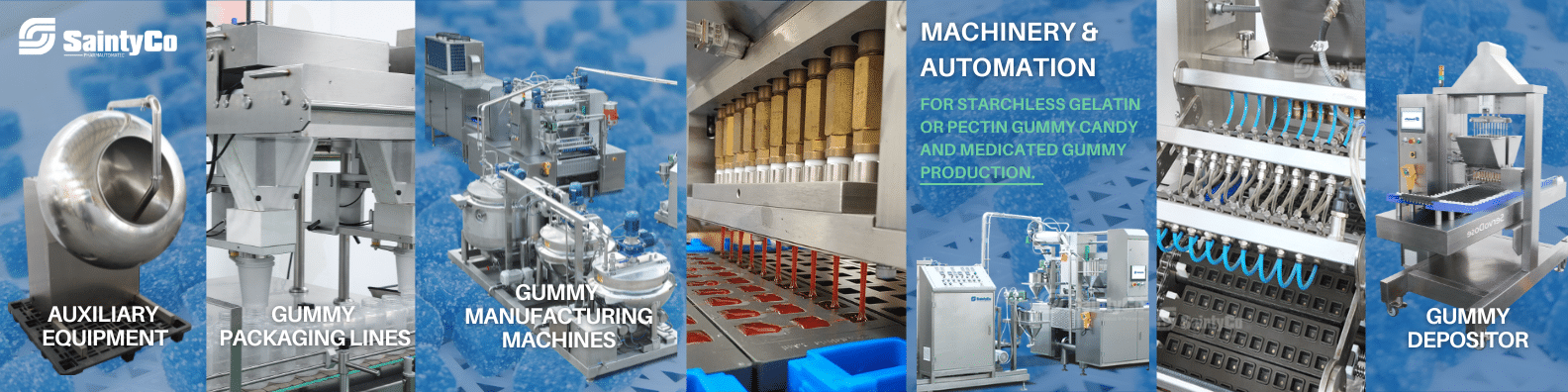

Machinery and Equipment

Investing in quality gummy machinery is essential for efficiency. The choice between semi-automatic and fully automatic gummy making machines depends on your scale of production. Equipment costs also include maintenance and potential upgrades. Explore various gummy making machines2 to align with your business goals.

Labor Costs

Labor is a significant expense, encompassing salaries, training, and benefits. Hiring skilled workers can improve production quality but will increase costs. Balancing labor costs with automation can optimize your budget. Consider the implications of local labor laws and labor cost management3.

Packaging Solutions

Packaging not only affects the cost but also influences consumer perception. Options range from simple plastic bags to eco-friendly materials. Investing in appealing designs can boost sales but might require a higher initial investment. Learn about different packaging materials4 to find a cost-effective solution that complements your brand.

Marketing Expenses

Marketing is crucial for reaching potential customers. Costs include digital marketing, trade shows, and promotional materials. A well-planned marketing strategy can lead to high returns on investment. Explore innovative marketing tactics and digital marketing strategies5 to maximize your outreach efforts.

| Cost Component | Considerations |

|---|---|

| Raw Materials | Type, cost variations |

| Machinery | Initial cost, maintenance, upgrades |

| Labor | Salaries, training, legal requirements |

| Packaging | Material choice, design impact |

| Marketing | Channels, ROI |

By breaking down these components, you can create a financial model that supports growth and sustainability in your gummy making business. Understanding these elements ensures that you make informed decisions tailored to your unique business needs.

Gelatin is more cost-effective than pectin.True

Gelatin is generally cheaper than pectin, which is a plant-based alternative.

Fully automatic machines are always cheaper.False

Fully automatic machines often have higher initial costs compared to semi-automatic ones.

Which Funding Options Are Best Suited for New Gummy Ventures?

Launching a gummy business demands strategic funding. Options abound, each with its own benefits and drawbacks. But which suits your unique needs? Let’s explore the choices to fuel your venture's growth.

For new gummy businesses, the best funding options typically include self-funding, small business loans, angel investors, venture capital, and crowdfunding. Each option has unique benefits and challenges depending on your business model and goals.

Exploring Self-Funding and Bootstrapping

Self-funding is often the first choice for entrepreneurs. It offers complete control over your business without outside interference. However, it also means assuming all financial risks. Consider tapping into savings or liquidating assets. Bootstrapping encourages lean operations from the start, focusing on efficient spending6.

Small Business Loans

Banks and credit unions provide small business loans. They are ideal if you have a solid credit history and a detailed business plan. These loans can finance initial costs like manufacturing equipment or marketing campaigns. Evaluate interest rates and repayment terms carefully to ensure sustainability7.

| Loan Type | Interest Rate Range | Repayment Term |

|---|---|---|

| SBA Loan | 5-10% | 10-25 years |

| Term Loan | 6-15% | 1-5 years |

Attracting Angel Investors

Angel investors offer capital in exchange for equity, which can significantly boost your resources without incurring debt. They may also bring valuable expertise and networking opportunities to the table. Be ready to share your vision passionately and precisely to attract the right investors8.

Venture Capital

If your gummy venture promises high growth, consider venture capital (VC). VCs provide large-scale funding but require substantial ownership stakes and often a say in company decisions. This option is suitable if you’re targeting rapid expansion and can meet stringent performance targets.

Crowdfunding

Platforms like Kickstarter or Indiegogo allow you to raise small amounts of money from many people, turning potential customers into investors. It's excellent for validating demand for your product early on. Successful crowdfunding requires compelling storytelling and a strong marketing strategy9.

Choosing the Right Fit

Your choice depends on factors like the amount needed, control preferences, growth projections, and risk tolerance. Mixing multiple funding sources can also be strategic, balancing equity with debt while maintaining flexibility. Engage with a financial advisor to align funding strategies with your long-term vision.

Self-funding offers complete business control.True

Self-funding avoids outside interference, giving full control.

Venture capital requires no equity exchange.False

Venture capital involves giving substantial ownership stakes.

How to Price Your Gummies for Maximum Profitability?

Pricing your gummies right is pivotal to ensuring profitability. It involves balancing production costs with market demands and competitive pricing. A strategic approach can help you maximize profits while appealing to your target audience.

To price your gummies for maximum profitability, calculate all costs including production, packaging, and distribution. Analyze competitor pricing and determine your unique value proposition. Then, set a price that covers costs and aligns with market expectations.

Understanding Your Costs

The first step in pricing your gummies is understanding your costs. Break down all expenses involved in production. This includes raw materials like gelatin and flavoring10, labor costs, packaging, and distribution fees.

| Cost Component | Description |

|---|---|

| Raw Materials | Ingredients needed for gummy making |

| Labor Costs | Wages for workers in production line |

| Packaging | Containers, labels, and wraps |

| Distribution | Transport and logistics |

Competitor Analysis

Research your competitors to gauge the market. Evaluate their pricing strategies and identify where you can position your product. Offering unique features like organic ingredients11 or CBD infusion can justify a higher price point.

Establishing Your Unique Value Proposition

Your unique value proposition (UVP) differentiates your gummies from others. Whether it's the health benefits of vitamin-infused options12 or eco-friendly packaging, this element can add perceived value, allowing you to set a premium price.

Pricing Models to Consider

Choosing the right pricing model is crucial:

- Cost-Plus Pricing: Add a standard markup to your total costs.

- Competitive Pricing: Set prices based on competitors' rates.

- Value-Based Pricing: Price according to perceived value by consumers.

A combination of these models might suit your needs, depending on your market research findings.

Calculating Break-Even Point

To ensure profitability, calculate your break-even point. This is where total costs equal total revenue. Anything beyond this point is profit.

- Formula:

Break-Even Point = Total Fixed Costs / (Price per Unit - Variable Cost per Unit)

Evaluating this calculation will aid in determining the minimum price you should charge to cover all expenses and start making profit.

Monitoring Market Trends

Stay informed about market trends that can impact your pricing strategy. Economic shifts or ingredient shortages can affect costs. Tools like market trend analysis13 can provide insights into when to adjust prices appropriately.

Cost-plus pricing adds a standard markup to total costs.True

Cost-plus pricing involves adding a fixed percentage markup to production costs.

Competitor analysis is irrelevant in gummy pricing strategy.False

Competitor analysis helps position your product and informs pricing decisions.

Why Consult a Financial Advisor When Planning Your Business Finances?

Considering a financial advisor for your business finances? Discover how expert guidance can transform your financial strategy, enhance profitability, and provide peace of mind.

Consulting a financial advisor can optimize your business finances by offering tailored strategies for budgeting, forecasting, and risk management. They help ensure financial health, improve cash flow, and provide insights for informed decision-making.

Understanding the Role of a Financial Advisor

A financial advisor helps streamline your business financial planning14 by identifying potential areas for cost savings and investment. They provide an external perspective on your financial situation, which can be invaluable in navigating complexities you might not foresee.

Benefits of Professional Financial Guidance

Engaging with a financial advisor offers numerous advantages:

- Strategic Budgeting: Advisors assist in creating realistic budgets that align with your business goals.

- Risk Management: They evaluate potential risks, enabling you to make informed decisions to protect your assets.

- Investment Optimization: Advisors provide insights into efficient investment strategies, maximizing returns while minimizing risks.

| Benefit | Description |

|---|---|

| Strategic Budgeting | Aligns budgets with business objectives |

| Risk Management | Evaluates and mitigates potential financial risks |

| Investment Optimization | Maximizes investment returns while managing risks |

Customizing Financial Strategies for Your Business

Every business has unique financial needs. A financial advisor can tailor strategies to fit your specific industry, whether you're in gummy production15 or another field. By understanding your business model, they can offer customized solutions that support sustainable growth.

Common Misconceptions About Financial Advisors

Many business owners think financial advisors are only necessary for large enterprises. However, even small businesses benefit from their expertise. Advisors bring specialized knowledge that can improve financial efficiency, leading to substantial savings and growth over time.

- Myth: Financial advisors are too expensive for small businesses.

- Reality: Their services often lead to long-term savings that outweigh initial costs.

Real-Life Examples of Financial Advisory Success

Consider a startup seeking to launch a new product. By working with a financial advisor, they could effectively manage their resources and timelines, ultimately achieving successful market entry. Another example is a company that improved its cash flow by implementing advisor-recommended strategies for inventory management16.

- Case Study 1: Successful product launch through strategic resource management.

- Case Study 2: Enhanced cash flow via improved inventory controls.

By consulting a financial advisor, you're equipping your business with the tools necessary for financial success and resilience. They offer not just advice but a partnership in steering your company toward profitability and stability.

Financial advisors only benefit large enterprises.False

Even small businesses can gain from financial advisors' expertise.

Financial advisors help in strategic budgeting for businesses.True

They align budgets with business objectives for better financial planning.

Conclusion

Learn how to secure funding and create a financial plan for your gummy business, covering cost estimation, funding sources, pricing strategies, and the benefits of consulting a financial advisor.

At GummyGenix by SaintyCo, we don’t just provide equipment—we empower your gummy business with solutions tailored to your success. Here’s what makes us the ideal partner for your venture:

- Competitive Pricing: Top-tier machinery at affordable rates, ensuring a strong return on investment.

- High-Quality Machinery: GMP-compliant, precision-engineered equipment designed to meet evolving industry standards.

- Equipment Financing & Referral Support: Access flexible payment options and financing resources through our trusted partners, helping you secure affordable payments and potential tax advantages.

- Quick Startup SOPs: Basic recipes and production workflows for a fast, hassle-free start. Additionally, we can connect you with leading formulation consultants and global ingredient suppliers for more advanced product development.

- Custom Molds & Recipes: Stand out in the market with bespoke gummy shapes and innovative recipes tailored to your brand.

- Comprehensive After-Sales Support: From setup and training to troubleshooting, we provide the guidance needed to ensure smooth operations and sustained success.

Contact us at GummyGenix by SaintyCo, you will ll gain the expertise, resources, and support to build a thriving gummy production business. Let’s succeed together.

Gummy Production Machinery from GummyGenix by SaintyCo | Click to Know More

-

Understanding ingredient sourcing helps in maintaining quality while managing costs effectively. ↩

-

Identifying suitable machines ensures efficient production aligned with business size. ↩

-

Efficient labor management balances cost control with production quality. ↩

-

Eco-friendly packaging enhances brand image and may attract more customers. ↩

-

Exploring digital marketing strategies boosts customer reach and business growth. ↩

-

Explore tips to minimize expenses while maximizing resources, crucial for self-funding and bootstrapping success. ↩

-

Learn how to secure and manage small business loans effectively to support growth without financial strain. ↩

-

Find strategies for enticing angel investors to fund your startup, enhancing capital and strategic support. ↩

-

Discover methods to create compelling campaigns that attract backers and validate your product idea. ↩

-

Discover high-quality suppliers for gummy ingredients, enhancing product quality and profitability. ↩

-

Learn why organic ingredients can justify premium pricing and attract health-conscious consumers. ↩

-

Explore how vitamin-infused gummies add health value, increasing consumer appeal and pricing potential. ↩

-

Find tools that help track market trends, assisting in strategic pricing adjustments. ↩

-

Explore the comprehensive role financial advisors play in strategizing and enhancing business financial plans. ↩

-

Learn about tailored financial strategies that can benefit businesses within the gummy production sector. ↩

-

Discover how optimizing inventory management can significantly enhance your business's cash flow. ↩